Crypto News Bites 2022/11/10

FTX & SBF face bankruptcy on $8b shortfall / Binance bails on FTX bailout / SEC & CFTC probes FTX

Top News Summaries

FTX and SBF bankrupt on $8b shortfall. Binance will not bail out FTX, “beyond our control or ability to help”. US regulators SEC & CFTC probing FTX. FTX.com website goes down.

14% SOL circulating supply will soon be unlocked from staking, possibly to sell on the back of FTX drama.

Meta fires 11k employees after spending $15b on Metaverse

Messaging app Line launches NFT marketplace

More details, news and analysis below!

Market Overview

Crypto markets continue to fall on contagion fears stemming from crypto exchange FTX’s insolvency (read yesterday’s bites). Coins related to FTX and sister company Alameda, mainly their FTT token and some on the Solana blockchain SOL, SRM, RAY etc fell over 40% as investors feared the two companies would have to sell the tokens in a fire sale to raise liquidity.

Outside of crypto, all eyes on Thursday’s US CPI print with estimates of 8%. But I don’t think it will affect crypto that much given the FTX overhang.

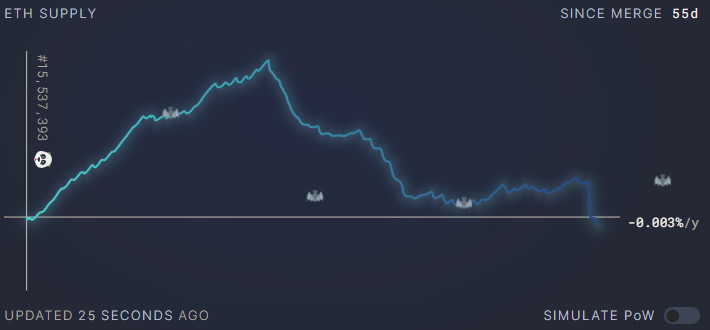

ETH has become deflationary yesterday as user activity spiked. As each transaction removes (or burns) the gas fee from circulation permanently, the flood of transactions has burned more ETH than the amount issued in the same time period, resulting in a decrease in the total circulating ETH supply. When real world inflation is 8%, all else equal a deflationary asset becomes much more valuable.

In other news, Elon Musk sold almost $4b of TSLA shares. His favorite memecoin DOGE was holding up well compared to the rest of the market, perhaps on speculation he will buy more. With just a $12b market cap, of which he may already have an unknown portion, likely that most of those funds would be used for something else.

FTX insolvency

Game over for FTX. Binance walks away from bailing out FTX, “beyond our control or ability to help”. WSJ reports FTX has a liquidity shortfall of $8b, bankruptcy likely. Unconfirmed reports that SBF filed for bankruptcy and personally owes $650m. US regulators SEC and CFTC both probing FTX’s handing of client funds and lending.

The total fallout from FTX is still unknown, but one of the top crypto VC funds Multicoin Capital announced it has 10% of the fund’s AUM stuck on the exchange, and their largest position is SOL. Also, Canada-listed Galaxy Digital (GLXY) announced in their Q3 earnings report that they had $76.8m exposure to FTX, but they have $1.5b in liquidity and $1b in cash. Nexo dodged a bullet, withdrawing $219m from FTX over 7 days. I’m expecting more companies with similar problems in the coming days.

As mentioned yesterday, FTX going under would set the industry back for a long time: retail investors will leave en-masse, institutional investors will treat the space as uninvestible, governments & regulators will clamp down, and the talent in the industry also leaves from a lack of funding (VC funding in Q3 down ~40%).

Centralized Finance Reassurances

Given the lack of transparency of centralized finance (CeFi), multiple exchanges have announced that they will publish proof of reserves: Binance, Gate, KuCoin, OKX, Huobi & Poloniex, Bitget. Binance also topped up their insurance fund to $1b composed of BTC, BNB & BUSD, although I question the efficacy as a hack would cut the BNB value and BTC would also likely take a dip.

Crypto institutions such as Coinbase, Genesis, Crypto.com, BlockFi & Wintermute all rushed out to tweet that they had little or no exposure to FTX in an attempt to calm clients (and possibly avoid their own bank run). Stablecoin issuers Circle CEO tweeted about how safe they were through their attestations and Tether’s CTO also tweeted of zero exposure to FTX and Alameda.

In other CeFi news, exchange Bitmex will launch its BMEX token on 11/11.

Solana Unstaking

Another potential piece of bad news for Solana. Over 50m SOL or nearly 14% of the coin’s circulating supply will be unlocked from staking in the next few hours. Typically token holders will stake their coins with validators to earn a staking yield, and when they unstake, after a period of time their tokens are unlocked and they are free to transfer their tokens… or to sell them because of their connection to FTX. This could be the capitulation event.

This affects decentralized finance (DeFi) as well, as one example is lending protocol Solend (SLND) starting to liquidate one user who borrowed $44.8m after providing $51m in SOL, as the value of the collateral has dropped sharply. However due to poor liquidity conditions / network congestion, the liquidations have been slow, and currently the protocol has reduced the borrow amount to $24.8m but the collateral has fallen further to $17.6m.

Adoption

…Or lack thereof. Meta fires 11k employees after spending $15b on their version of Metaverse that failed to attract users. The current implementations of the Metaverse is not seeing adoption, with statistics showing that SAND saw less than 6k users and MANA with less than 3k over the past 7 days. These tokens are still ~$1b market cap.

Japanese messaging app Line launches NFT marketplace. They have 178m monthly active users, so this could be another step towards greater blockchain adoption through NFTs.

Lost in all the FTX drama, multiple crypto companies are gearing up for the World Cup. OKX launches it’s Football Festival with more than $3m tokens in the prize pool. Visa & Crypto.Com launched new NFT collection auction. CHZ could be the most direct play with their football fan social tokens on Socios.

Raises

Crypto payments firm Ramp raises $70m in a series B round, which the founder says was more than 50% increase in valuation. As mentioned yesterday, I prefer to have multiple options available to move capital into/out of crypto, and not just through centralized exchanges.

London based crypto exchange Archax raised $28.5m series A led by Abrdn

Fordefi, launching an institutional defi wallet, raised $18m seed from investors including Lightspeed, Electric, Alameda (?), Pantera, Jump, DeFiance etc

Sepana, launching a search tool for web3 content such as DAOs and NFTs, raised $10m funding round from investors including Hack and Pitango

Tokens Mentioned Today

BTC ETH DOGE FTT SOL SRM RAY SLND SAND MANA CHZ

good stuff, keep it coming

Keep up the daily tidbits loving them!